Pinpointing the AWS Node with the Lowest Latency to the crypto exchanges, Lightning Locator is purpose-built for high-frequency trading environments where every millisecond counts. It precisely identifies the AWS node geographically and logically closest to the target exchange, ensuring the lowest possible network latency. The system automatically searches for nodes based on specific benchmark requirements, leveraging years of expertise to fine-tune parameters and significantly reduce node discovery process. Once the optimal node is identified and delivered to the client, the system continuously monitors its performance to ensure readiness for future scaling.

Optimized for

Speed and

Efficiency

With proven expertise in institutional-grade trading, QTX delivers ultra-low latency infrastructure through strategic global co-location. Our technology optimizes your entire trading environment, providing microsecond-level execution, reduced costs, and a decisive competitive edge in today's high-velocity markets.

$1 Million

/ annual

Cost Saving

100X Faster

Computing Power

30%

Latency Improvement

Technology as

a Service

-

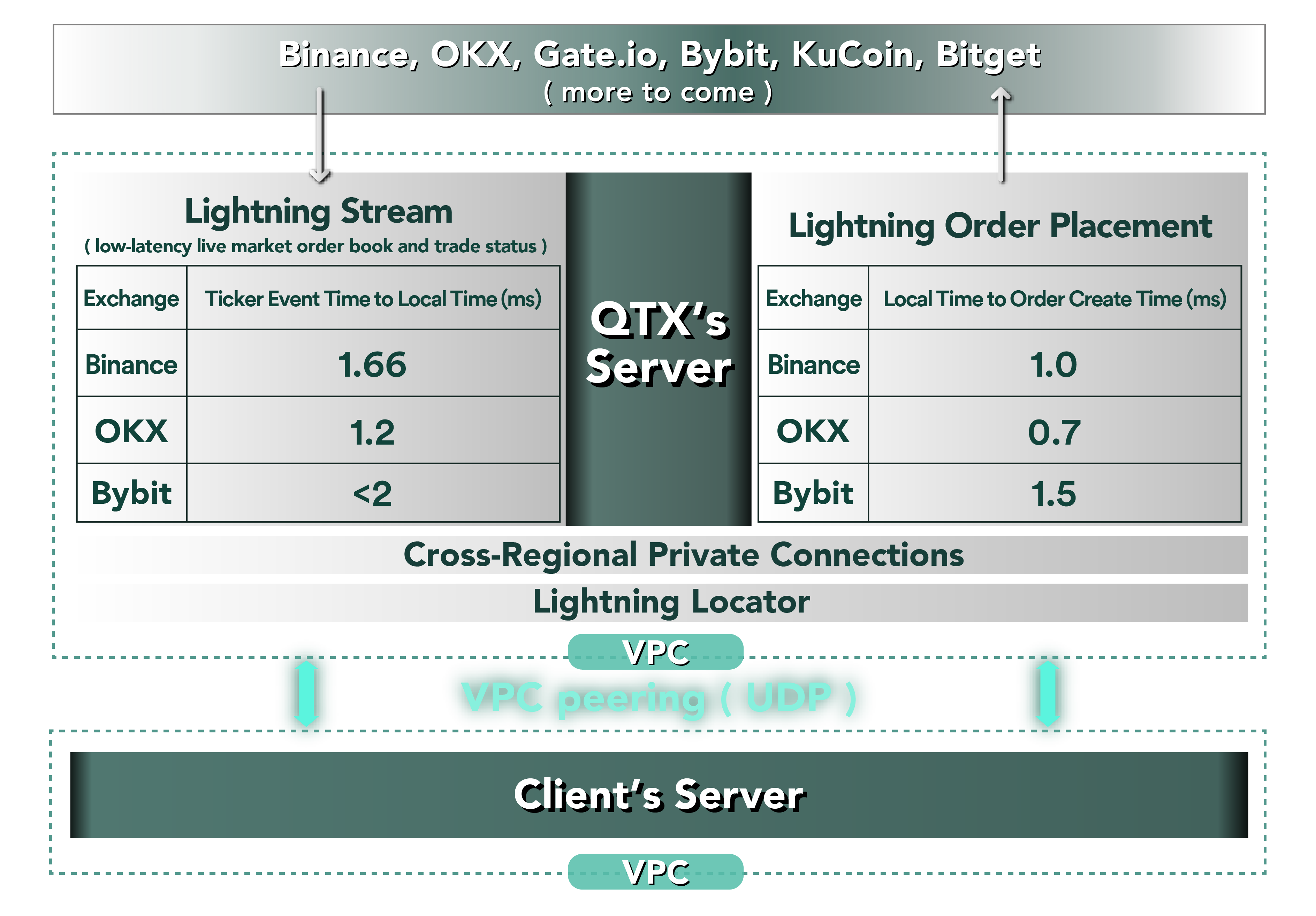

Lightning Stream

Users of this service will be able to receive current market trading activity status before the “exchange public feed”, and thus determine the best order placement strategy before the peers.

-

Lightning Order Placement

With our proprietary “optimal trading environment”, orders placement through us will have less latency than in-house modules to gain trading advantage.

-

Lightning Locator

Locating an AWS instance offering the fastest connection to Binance—based on both physical proximity and network topology.

-

Volume Boost Program

Through our high-frequency trading strategies, we help clients reach their target trading volumes, upgrade their VIP status, lower their trading fees, and enhance the returns of their other strategies.

-

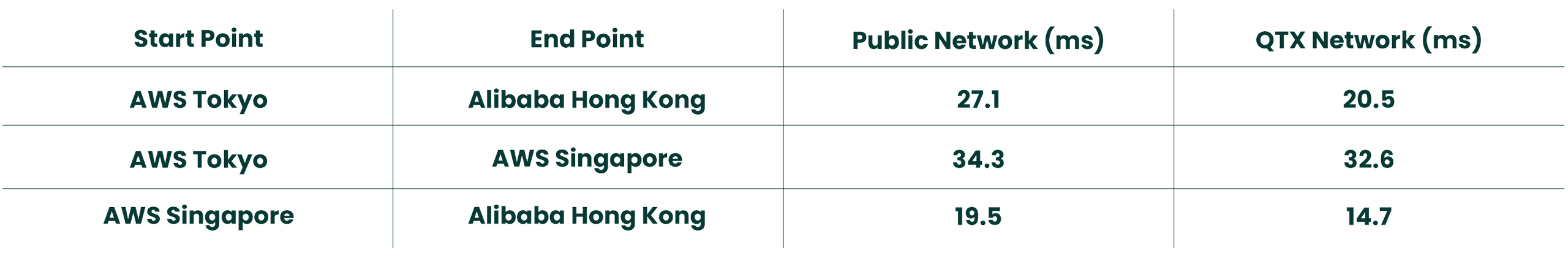

Cross-Regional Private Connections

Through our low-latency cross-regional private connections, the cross-exchange execution speed can be improved by over 30%.

-

Low Slippage Order Execution

To obtain the best order efficiency for clients (price, quantity, execution speed etc.), these orders can be executed by HFT technologies that provide the lowest slippage (even negative) while profit from order pricing difference.

Common

Use Cases

High-Frequency Trading

Capture short-term market opportunities with microsecond-level execution.

Quantitative Trading

Deploy and optimize complex algorithmic strategies with minimal latency.

Arbitrage Trading

Identify and act on price discrepancies across multiple exchanges in real time.

Multi-Exchange Trading

Seamlessly trade across platforms through a unified connection to maximize reach and efficiency.

Single Exchange Optimization

Enhance execution speed and reliability when operating on a single exchange.

Large Volume Transactions

Maintain stability and low slippage when executing high-volume trades.

TAAS-

Lightning

Trading

System

TAAS-

Cross-Regional

Private

Connections

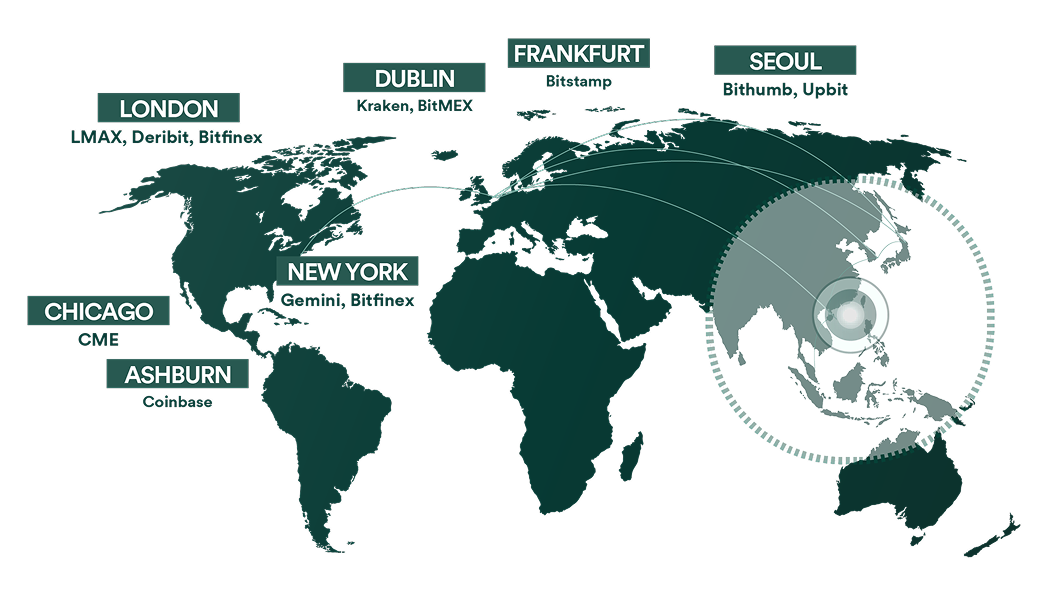

Low-Latency Multi-Exchange

Trading Solutions

Through our low-latency cross-regional private connections, the cross-exchange execution speed can be improved by over 30%.

TAAS -

Lightning Locator

To binance vip endpoints

( stream / ws-api )

average ping RTT

Our specially-picked instance : 140 - 150 µs

General instances : 230 µs

TAAS -

Volume Boost

Program

Through our high-frequency trading strategies, we help clients reach their target trading volumes, upgrade their VIP status, lower their trading fees, and enhance the returns of their other strategies.

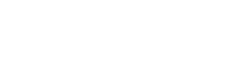

Assist Clients to Achieve or Maintain

VIP Level 5 - 9

Spot MM Program tier 1- 4

UM MM Program tier 1- 3

VIP 8, DMM tier

-

Help client achieve VIP8, SPOT MM Program Tier3. Provide ~ 0.5% Market Share

2024 / 12 / 01 ~ 2025 / 05 / 31

Total trading volume :

6,258,981,423.769 USDT

TAAS -

Low Slippage Order Execution

To obtain the best order efficiency for clients ( price, quantity, execution speed etc.), these orders can be executed by HFT technologies that provide the lowest slippage (even negative) while profit from order pricing difference. Leveraging our existing Lightning order placement clients and internally-developed AI price matching engine initially, further collaborations with market makers and exchanges together with BD customer acquisition effort will boost our scaling momentum.

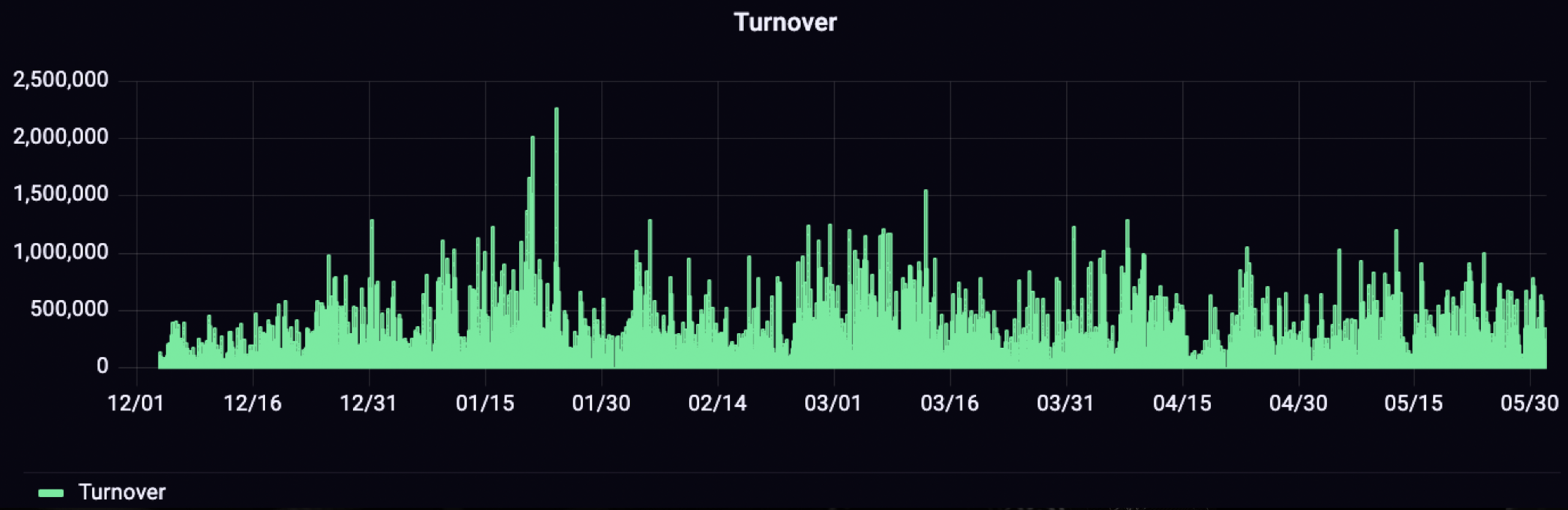

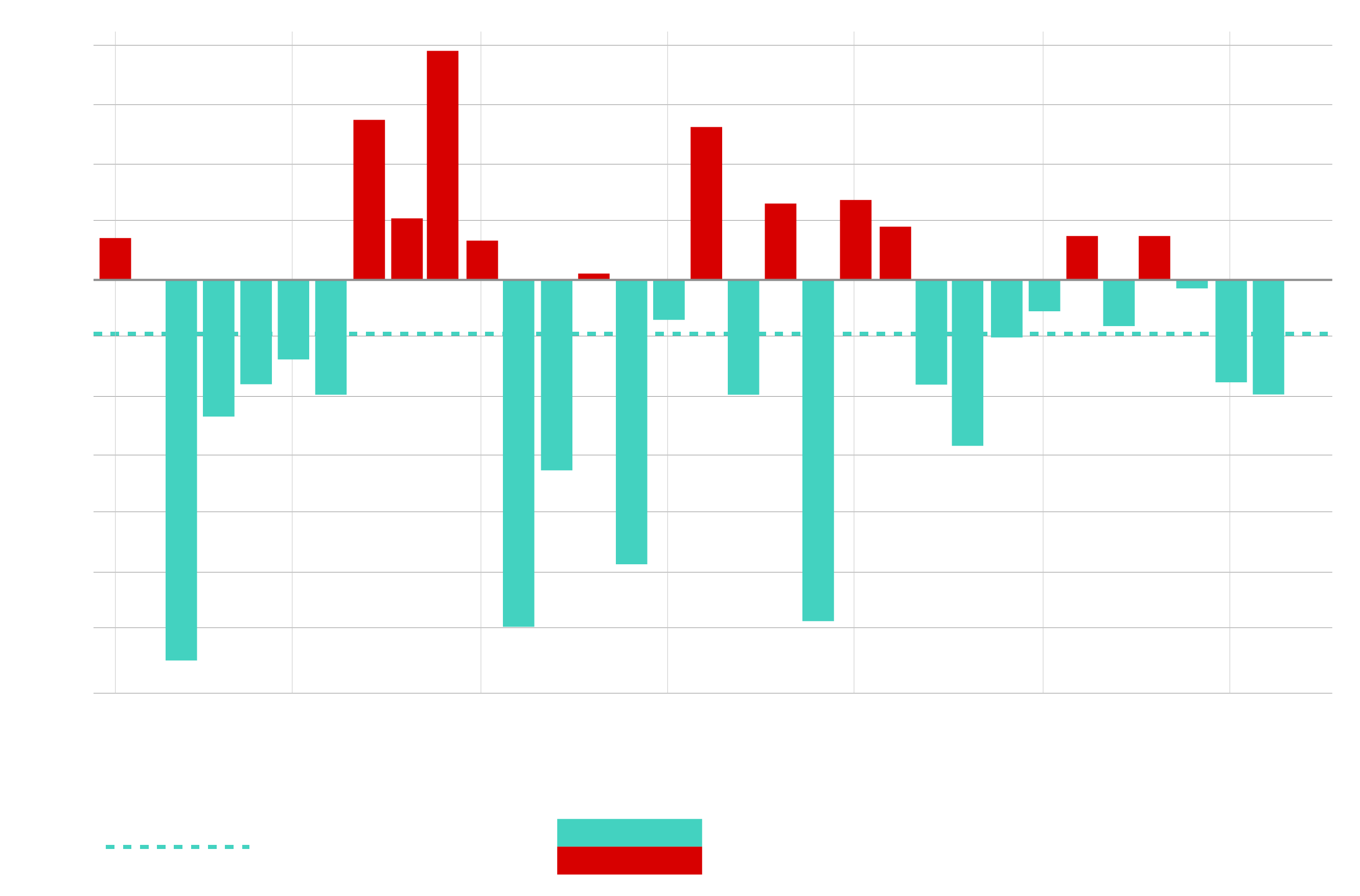

Below is a comparison of Low Slippage Order Execution (Signal-driven) versus VWAP (Volume-Weighted Average Price) for purchasing 50 BTC within one month.

The average slippage is

-0.4642 bp

Below is a comparison of Low Slippage Order Execution (Signal-driven) versus TWAP (Time-Weighted Average Price) for purchasing 50 BTC within one month.

The average slippage is

–0.4852 bp

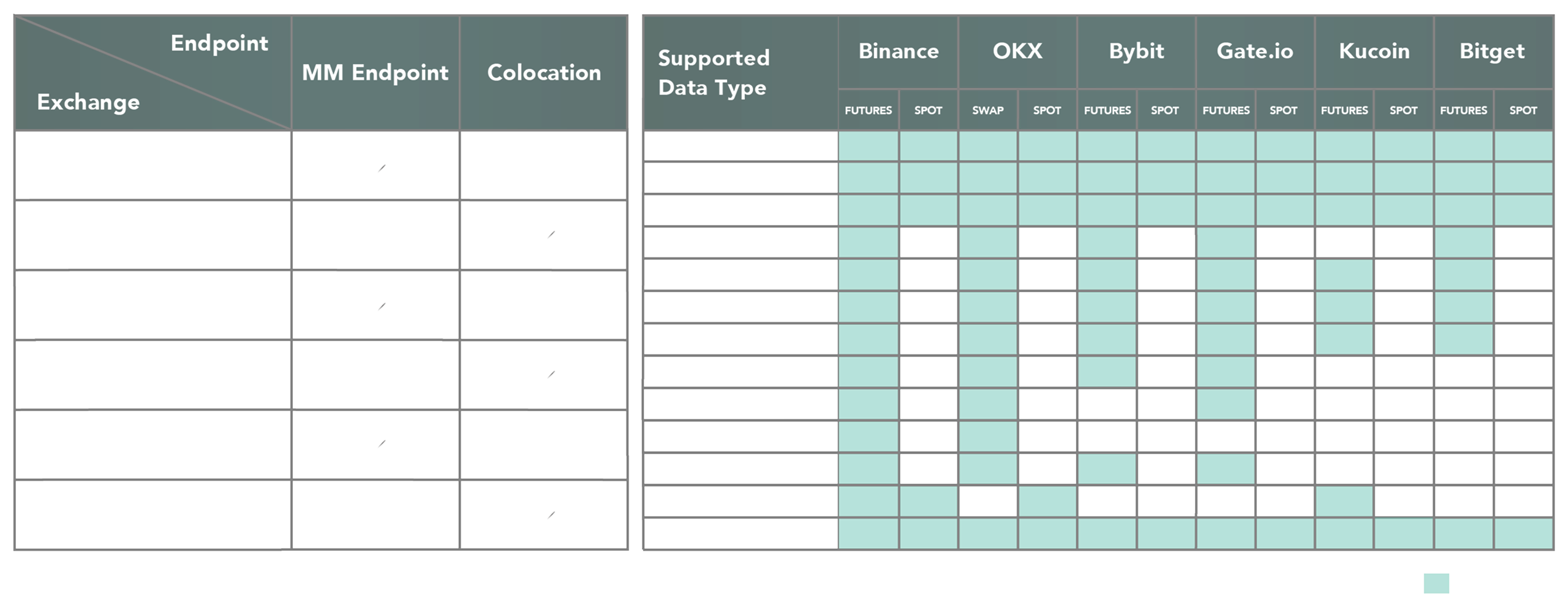

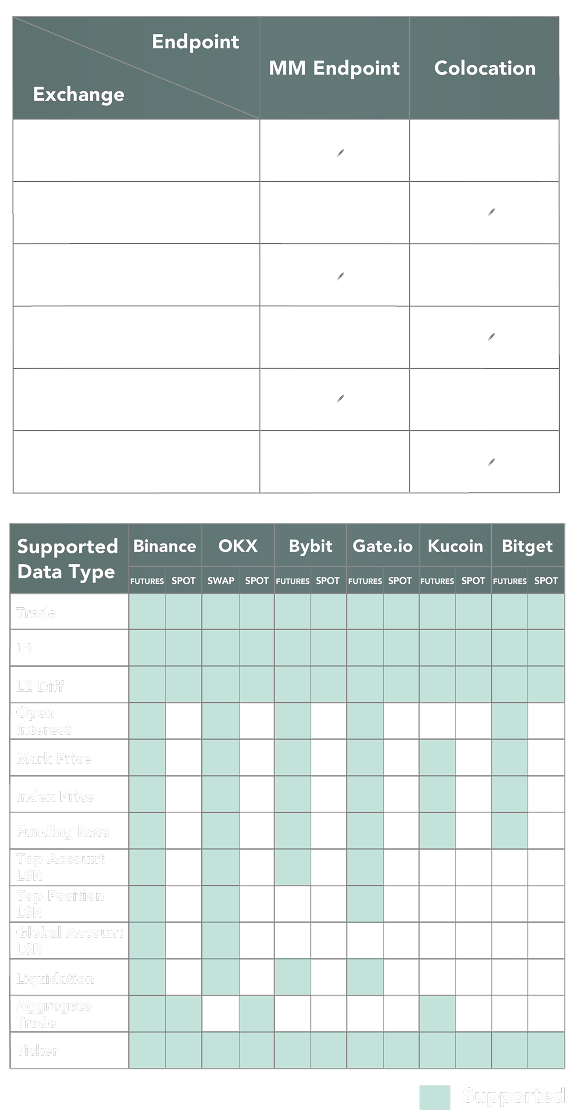

TAAS - Data Service

Lowest latency all symbol data sets, collected at main crypto trading venues

Other exchanges: can confirm with us first